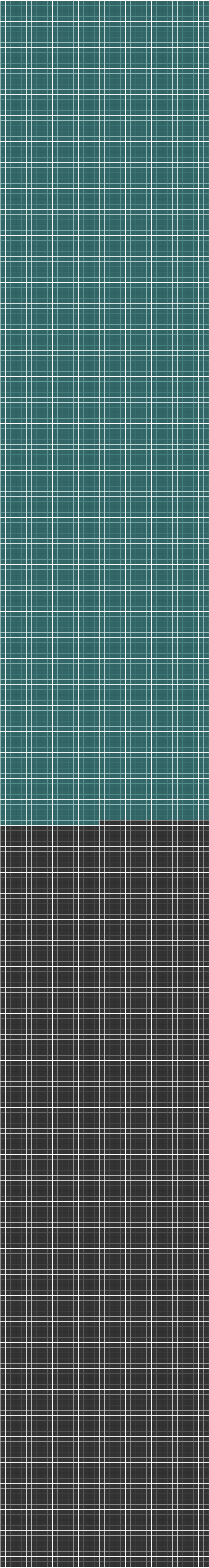

The Money Project , founded in 2015, develops original infographics for money. Below one of them. Beware of vertigo!

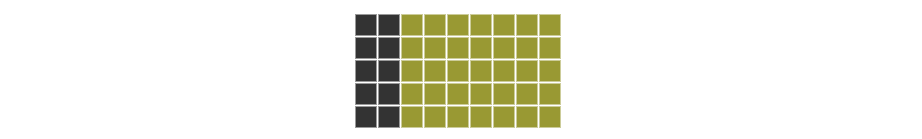

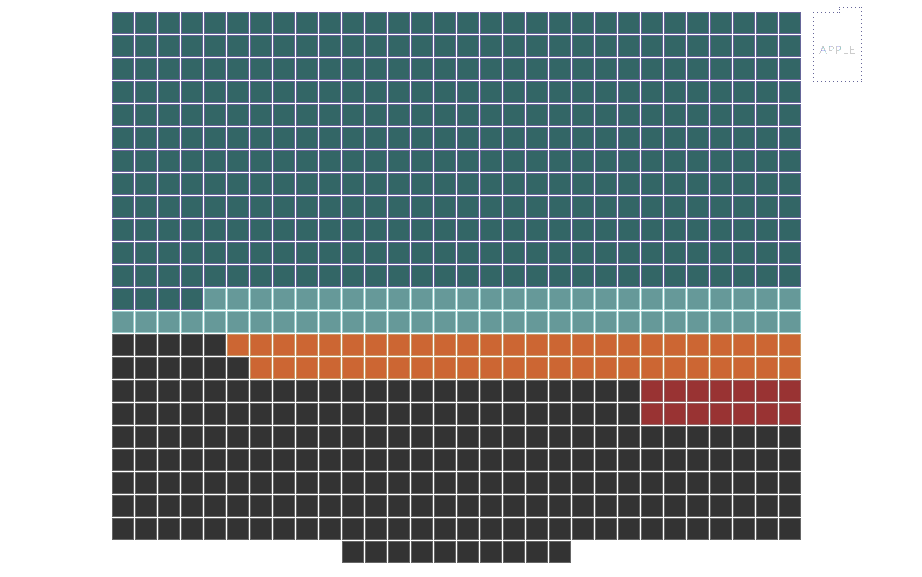

COMPARING THE WORLD'S MONEY AND MARKETS

each square of this size

represents €100 billion

represents €100 billion

BITCOIN

The market capitalization of this cryptocurrency reached a peak of $14 billion in 2013.

SILVER

using a $14/oz spot price.

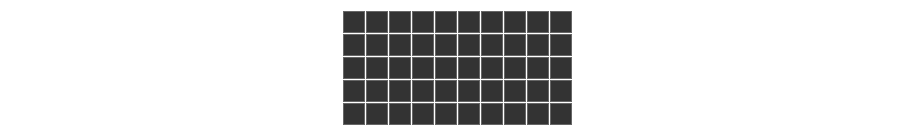

WORLD'S RICHEST PEOPLE

Bill Gates is the world's richest person again with a fortune of $79.2 billion.

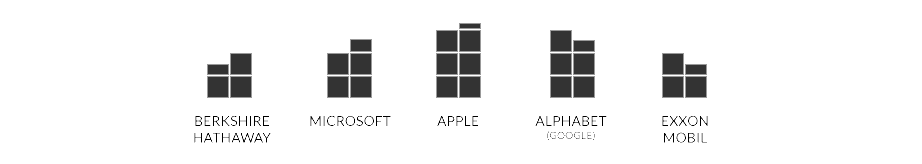

WORLD'S BIGGEST COMPANIES

FED'S FEDERAL RESERVE BALANCE SHEET

due to controversial quantitative easing (QE) programs.

$3.5t Added During QE

$3.5t Added During QE

COINS AND BANKNOTES

COMMERCIAL REAL ESTATE

This is a still a fraction of the total ofall real estate.

36% Americas (36%)

36% Americas (36%)

31% Europe (31%)

31% Europe (31%)

30% Asia Pacific (30%)

30% Asia Pacific (30%)

4% Middle East + Africa (4%)

4% Middle East + Africa (4%)

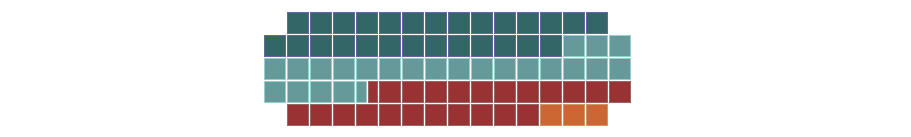

GOLD

Using a $1,200 spot price, the world's gold is worth $7.8 trillion

.

.

17% Heldby lMF and Central Banks

17% Heldby lMF and Central Banks

NARROW MONEY

This includes the world's coins, banknotes, and checking deposits.

ALL STOCK MARKETS

52% United States

52% United States

8% European Union

8% European Union

7% Japan

7% Japan

2% China

2% China

31% Rest of the World

31% Rest of the World

BROAD MONEY

This includes coins, banknotes, money market accounts, as well as saving, checking, and time deposits.

ALL GLOBAL DEBT

329% accumulated since the 2008 financial Crisis.

Included in the above amount is $59.7 trillion of sovereign national debt

.

.

329% United States

329% United States

336% Europe

336% Europe

320% Japan

320% Japan

36% China

36% China

319% Rest of the world

319% Rest of the world

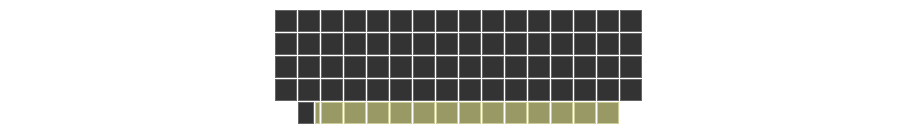

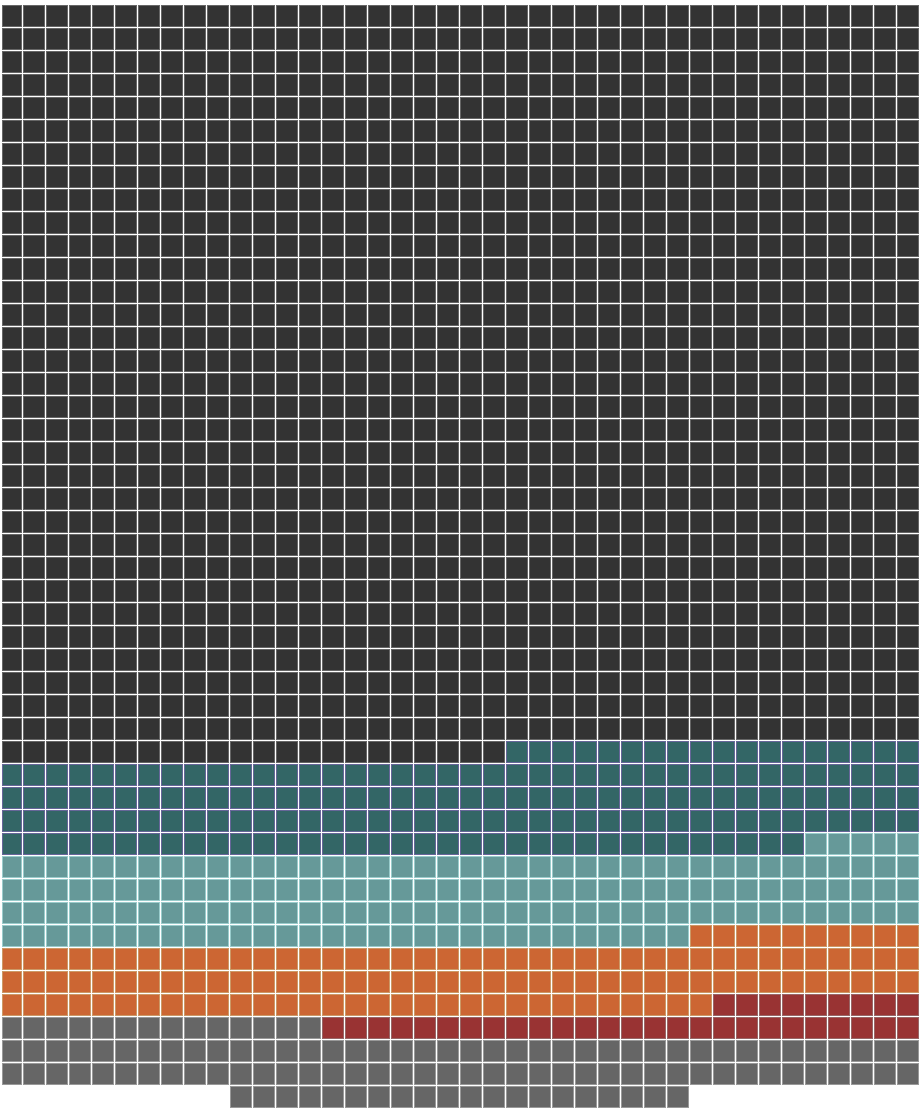

DERIVATIVES

WHAT'S A DERIVATIVE?

A derivative is a contract between two or more parties that derives its value from the performance of an underlying asset, index, or entity.EXAMPLES OF DERIVATIVES:

Futures contractsForward contracts

Options

Warrants

Swaps

Banks typically use high amounts of leverage to attain these positions. Some derivatives, such as commodity futures, are traded on regulated exchanges such as the Chicago Mercantile Exchange (CME).

However, the majority of derivatives are traded outside of exchanges between private companies, and are called "over-the-counter" trades.

Collateralized debt obligations and credit default swaps are two derivative types that are now infamous for their roles in the 2008 Financial Crisis.

/

/  Here we've reached the low-end estimate of $630 trillions.

Here we've reached the low-end estimate of $630 trillions.

The high-end estimate for the value ofall derivative contracts is as high as $1.2 quadrillion.

The truth is that no one really knows the exact size of the market.

VIEWS ON DERIVATIVES:

Many finance professionals consider derivatives to be "zero-sum" trades - in other words, there is a winner and loser on each side of the bet.However, other experts warn that the massive size of the derivatives market could contain significant risk and consequences to global markets.

The positives are derivatives can be used to help allocate and take price risk out of everything from corn to cattle to stock. There are good derivatives that are self-regulating such as interest rate swaps and currency forwards. I've been working for exchanges for 41 years. I do not think regulation is incompatible with an efficient market. I think derivatives promote efficiencies.

(Dr. Richard Sandor)

The derivatives genie is now well out of the bottle, and these instruments will almost certainly multiply in variety and number until some event makes their toxicity clear. Central banks and governments have so far found no effective way to control, or even monitor, the risks posed by these contracts. In my view, derivatives are financial weapons of mass destruction, carrying dangers that, while now latent, are potentially lethal.

(Warren Buff)

A newer and updated version of above visualisation is available on "The money projet" website (see Sources)